One of the key differentiators in the White Oaks investment process for accredited investors is the use of non-traditional or alternative investments. Many are aware that nontraditional investing/alternative investments have long been used by wealthy investors, pension plans, and endowments. In fact, David Swenson, author of “Pioneering Portfolio Management” and Chief Investment Officer of the Yale endowment found great results in focusing attention on alternative investments to achieve stellar results.

© 2017, White Oaks Investment Management, Inc

After experiencing the financial crises in 2007-2008 White Oaks felt a critical need to lower volatility and add additional factors of return to portfolios. The White Oaks philosophy is illustrated by the White Oaks three-legged stool. Growing up on a farm one of my chores was to milk the cow. The three-legged stool was an important tool to maintain a solid place to sit since the floor was dirt and uneven. The investment markets are much the same, uneven and ever-changing.

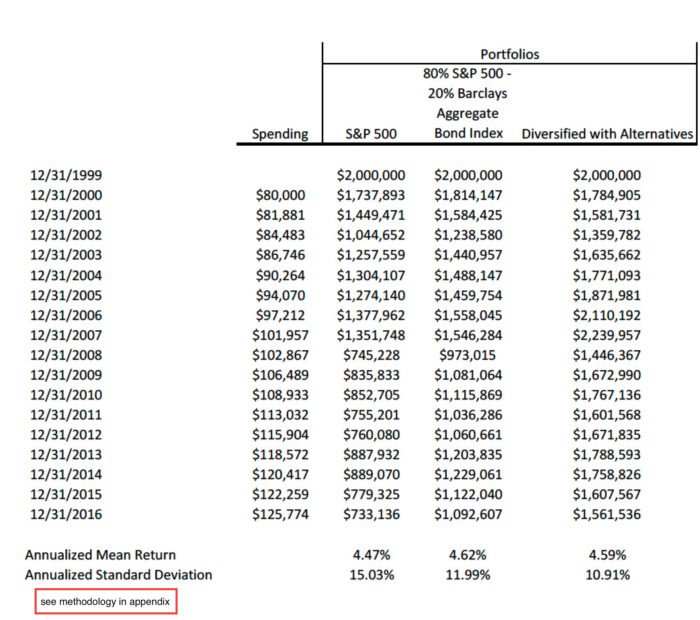

In the chart above note a beginning balance of $2,000,000 at the end of 1999. This illustration shows an individual withdrawing an initial 4% of the capital balance and adjusts for inflation each year. Note also that over the period, $1,750,860 of withdrawals are made. In the column entitled S&P 500(without alternative investments) the outcome of the actual history of the index, gross of fees, over that time period shows an ending balance of $733,136. A little bit more than 1/3 of the starting capital! The rate of return using this cash flow example is 4.47% and an annualized standard deviation of 15.03%. Maybe the results someone would prefer?

The Column entitled 80% S&P 500 – 20% Barclays Aggregate Bond (no alternative investments) has the same starting balance, time period and withdrawals. The rate of return is very similar at 4.62% but the measure of volatility is only 80% of the S&P 500 column. The lower fluctuation is a significant difference and results in ending capital of $1,092,607 or 49% more than the S&P 500 column! Volatility matters and matters a great deal!

Now let’s add the second and third legs of the stool to the mix. In the last column, entitled Diversified with Alternatives using alternative investments, the rate of return is actually slightly lower but the measure of volatility is the lowest of the three and results in 113% more capital than the S&P and 43% more capital than the 80-20 portfolio. With 30% of the portfolio allocated to the second and third legs of the portfolio, the results, when actually using the portfolio, are enhanced dramatically. The results are shown using index performance of specific managers since we wanted to show conceptually the value that additional diversification can add to a portfolio. See the endnotes for methodology and disclosures on how this was calculated. Chasing returns often lead to more volatility and bad outcomes. Less can be more in an intelligently designed portfolio strategy.

Of course, due diligence and process are vital to the second and third legs of the stool. In my next article, “Alternative Investments: 7 Principles for Selection”, I will go through key items to consider in selecting investments for the second and third legs.

© 2017 White Oaks Investment Management, Inc.

Appendix/End Notes:

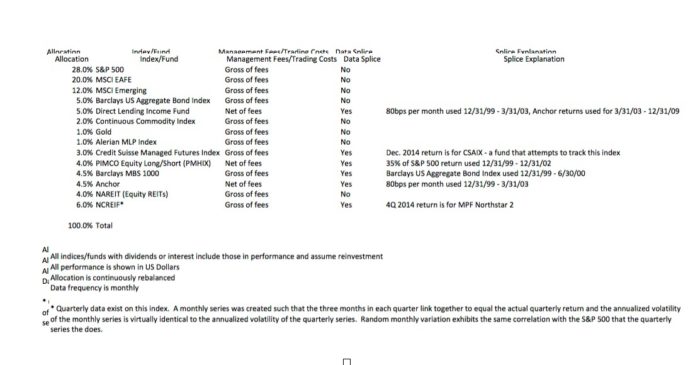

Assume a $2 million portfolio on 12/31/1999 and spending that is $80,000 in 2000, which grows each year by inflation plus 80bps. Spending reduces amount of portfolio by the full annual amount on the last day of the year after the market closes. The S&P 500, 80% S&P 500 – 20% Barclays Aggregate Bond Index, and Diversified with Alternatives columns show the growth of a portfolio invested as such inclusive of spending.

The S&P 500 and the 80/20 Benchmark are gross of management fees and trading costs.The “Diversified with Alternatives” is net of management fees, custodial fees, and legal fees. It is net of trading costs within the different funds that are used and gross of trading costs between funds that are used. The annualized management fee is 0.90% and the custodial and legal fees are 0.07%. These are deducted a the end of each month.

All portfolios with multiple components are continuously rebalanced (i.e. 80% S&P 500 – 20% Barclays Aggregate Bond Index and “Diversified with Alternatives”).”Diversified with Alternatives” is not the actual results of the Alternative Fund; it is actually the results of a back-tested portfolio that consistently maintains an allocation that is similar to the target allocation of the Alternative Fund as of the end of 2016. Please see separate table for more details on the back-tested allocation that is called “Diversified with Alternatives” in this table;