Should my portfolio be more conservative in retirement? This is one of the most frequent questions we receive.

Some old adages like “My portfolio should have the same percentage of bonds as my age” refuse to die. For example, a conservative approach would present as such. If I am 60 years old then I should have 60% bonds and 40% stocks. If I am 50 years old then I should have 50% bonds and 50% stocks. That was perfect advice when life expectancy was only about 12 years after a retirement at age 65 and coupon income from bonds were above 6%.

Times have changed.

However, times have changed. Today, our clients are living 30 and 40 years into their retirements, and currently, you can only get about 1.6% yield from a 10-year US treasury bond. With capital market assumptions (which are the expected average returns for the next 10 years) for the US equity market in the 5-6% range, combining that return with the return of a low yielding bond and expecting to take out 4% for an income need is courting disaster. You may be more likely to run out of money before you die.

Think of your portfolio strategy as a building block.

To sustain your portfolio for the long term, you must clear the income need first – so you need to return 4% – and then you need to clear another couple of percent to account for inflation. Remember, markets fluctuate every year: one year may be a negative return and other years will be marvelous years. You are looking for the average over time. If your plan in retirement is to only take out 2% of your portfolio as income, then of course you can afford to have a conservative portfolio. If your plan is to take 4% out, and you still have a long-life runway ahead of you, then you would be wiser to keep your portfolio less conservative. For our clients who qualify, we use alternative investments as bond replacements to create more yield but still keep the portfolio risk adjusted.

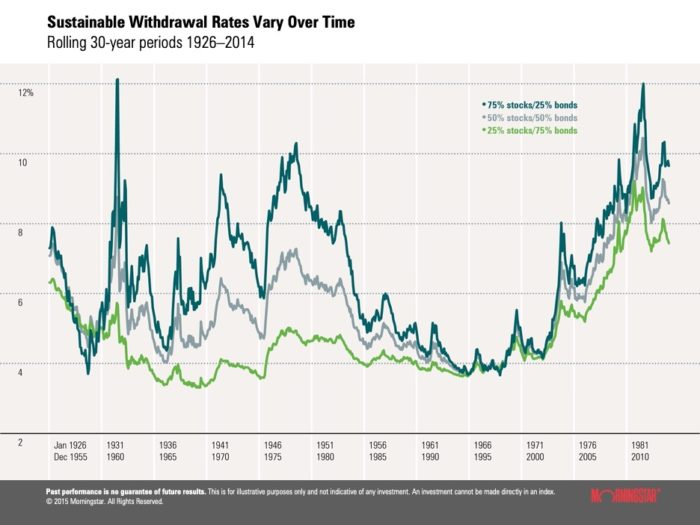

Historically, investors could take more from their portfolios because market returns were higher, and their expected longevity was shorter. This is one of my favorite charts because it shows you reasonable withdrawal rates over time and how they have fluctuated throughout time:

We constantly think about portfolio construction and the highest possibility way of investing to navigate the long retirements we now wonderfully face. Our 4% withdrawal advice today may be 3.5% or 5% advice in the future as long term market expectations can and do change. The portfolio adages of yesteryear should be left there.

Please contact the White Oaks Team for help or further questions regarding your portfolio strategy.

Disclaimer: Always consult with us for specific advice that fits your personal situation. The following guidance is meant to be a general rule of thumb.