Ukraine and Inflation

As I mentioned in my last economic update video, 2022 was expected to be a bumpier ride than 2021 given geopolitical and inflation concerns. Both of those twin troubles have been persistent concerns since the beginning of the year.

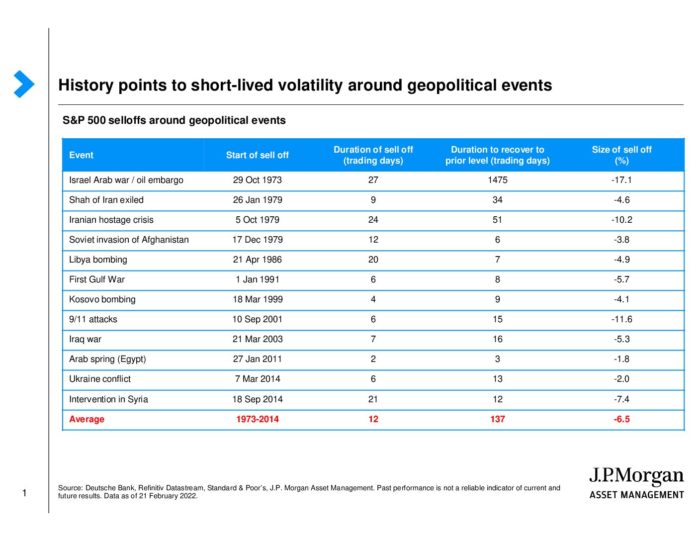

Long term investors are rewarded by staying the course. Markets endure geopolitical risks. Below is an interesting historical look at S&P 500 sell offs, including the duration, size and recovery time of each sell off.

What are some of the aspects that we review in these types of situations?

The first is reviewing the orderly operation of markets. These have been working well and have been uninterrupted. The past few days, the markets have seen trading volumes higher and good liquidity. Our global equity allocation has very little exposure to Russia. The Russian financial market itself is seized up because of sanctions on Russian banks and some Russian companies, but most US investors access these companies via the New York and London exchanges so liquidity and access remain normal.

The larger impact of this crisis has more to do with economic growth and inflation.

Russian oil and Ukraine grains will impact commodity markets. Geopolitical events interrupt supply chains and often cause commodity inflation. This has the trickle-down effect of slowing economic growth with higher input costs.

Yet, yesterday the US, and now today, the US, European and Asian markets had a positive rally. Why?

This crisis may cause the Federal Reserve to slow or delay their interest rate hike plan. This has a knock-on effect on companies and consumers who get to borrow at continued lower rates. Biden also allayed fears of an oil price crisis by promising to open strategic reserves and make sure domestic oil producers don’t try to inflate prices for profit.

Another consideration we analyze is will this conflict remain contained?

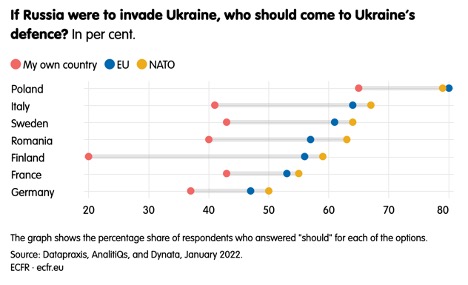

The 2000s have been the decades of globalization. We have all become interdependent, which leads to further disruption in times of conflict. In a report from the European Council on Foreign Relations, many European countries do not have the appetite to get into the Ukraine conflict themselves, but are willing to support a joint effort from NATO or the EU. The different polls showed that many European countries oppose the Ukraine invasion; however, they are less excited about assuming the resulting economic costs.

The world is also watching the reaction of the US and other nations, as the bigger economic fear is a China – Taiwan conflict.

The stronger the rest of the nations can stand together against aggressors, the more of a deterrent there will be. Setting aside for a moment the distressing personal and human rights nature of these conflicts, Taiwan, according to a report from Boston Consulting and the Semiconductor Industry Association in April 2021, accounts for 92% of the world’s most advanced semiconductor manufacturing capacity. You can see the tremendous impact a kink in that supply chain would put on companies if China were to make moves to control Taiwan.

So how does all of this translate into our portfolios?

From the beginning of the year, our value tilt has benefitted. Given the natural energy and commodity bent of value, rising commodity prices favor that overweight. Year to date, international developed and emerging markets plus value companies have been the leaders, all of which are overweights in our portfolios. Gold and managed futures have been good defensive positions.

Despite the current Ukraine invasion, the global economy has recovered significantly since the pandemic began.

The Federal Reserve wouldn’t even be considering raising rates if the economy was not in such a strong position. Companies are still turning out record profits, and there is still significant cash available for investment. Often, news like that gets overshadowed by the more emotional news of the day. Investors get rewarded by staying invested for the long term. We have faced geopolitical issues in the past, and we will again in the future.

If you have any questions, please contact the White Oaks’ Team.