Of course, seeking the best way to invest money is clearly a topic for anyone that has put a few dollars away for the future. As usual, seeking the easiest way and the best way to invest money is of high interest. Yet, the ‘easy button’ for investing money has not been invented. If it were the world would flock to it in droves.

Many would posit that the best way to invest money is to simply invest in index funds. At the same time, to invest in one asset class has its dangers. It is always frustrating and likely frightening to experience a significant market downturn. It seems like it comes just when the funds are necessary for tuition, retirement income, or that major purchase you have been scrimping and saving for. The market is volatile and investing in a single asset class offers little to no protection for investors.

With tongue in cheek, the perfect investment is one that pays ten percent annual interest, tax-free and backed by the full faith and credit of the United States government. No!! It does not exist, nor do the prospects seem at all likely. In my book, The Four Horsemen of the Investor’s Apocalypse, identified were four enemies of investors.

Four Investor Evils

- Inflation– The most often ignored when seeking the best way to invest money. The cost of goods and services will continue to trend up as they have for thousands of years. Solid investing strategies need to offset inflation to provide the financial security investors desire.

- Volatility – Investors LOVE upside volatility! Yet, as we have seen over the past few weeks, downside movements in the markets trigger emotional responses not consistent with a winning strategy. Controlling volatility is an important component of designing a plan engage the best way to invest money.

- Group-Think -The financial service organizations don’t always have an individual investor’s best interests at a heart. The ongoing debate with regard to the standards of care within various delivery systems underscore the conflicts within the financial services world. Investors need to look through the labels and packaging of financial service offerings. Investors need someone with training and experience and should seek a Certified Financial Planner (CFP) who operates on a fee-only basis and will act as a fiduciary in dealing with them. Yes, full disclosure, White Oaks Wealth Advisors are CFPs and act as fiduciaries with our clients. Our bias is that everyone should use a fee-only, CFP, fiduciary advisor.

- Global Disruptions and Dislocations – Our 24/7 news culture serves to accentuate investors’ emotions on a daily basis. Yet, most of the time, the impact on investment markets is short-term or not at all. In today’s news culture, the best way to invest money is to allocate over multiple asset classes. Then the portfolio will react in different ways when events happen. More on that below.

Post-Modern Portfolio Thinking

In considering the best way to invest money, we believe that a post-modern diversification strategy can offset inflation, reduce volatility, use the best in unique investment vehicles and account for the unforeseen global events the will undoubtedly come investors way. Traditional investing theory would use stocks, bonds and cash as the tools to construct a portfolio. Of course, much of today’s investing thinking is based on work done in the 1950’s using the term ‘Modern Portfolio Theory”. It espoused the notion that 90% of a portfolio’s return came from the asset class selection, not security selection. We would agree that when looking at those asset classes (3) that the conclusions are clear and indisputable. Lower costs and broad security exposure is a clear advantage when using these asset classes.

Evolving Thinking

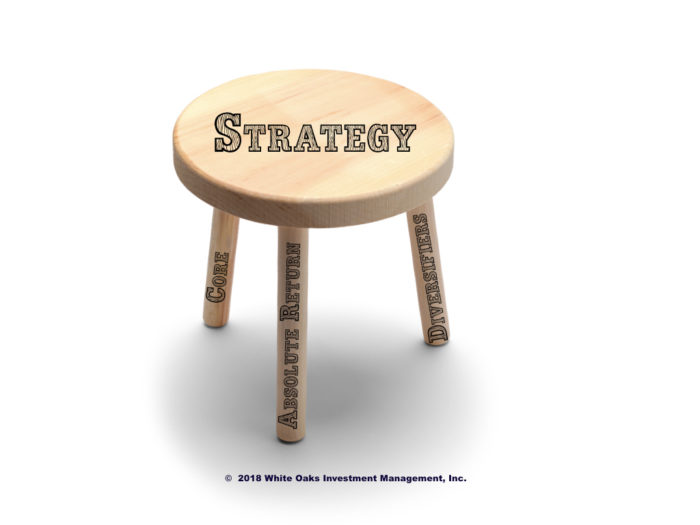

That said, the investing world has continued to evolve in its thinking over the years. Large endowments and mega-wealthy families have lead the way to an expansion of the notion of asset classes and their usefulness in constructing portfolios. White Oaks uses the metaphor of the three-legged stool to explain.

Core Leg

The “Core Leg” consists of traditional assets such as traditional assets classes such as stocks, bonds, and cash. This can take the form of ETFs Mutual Funds, Individual securities, etc. This provides broad-based exposure to the markets, keeping costs low. This enables the participation in the long-term growth of the global economy.

Diversifier Leg

The “Diversifier Leg” serves a much different role. Its purpose is to provide some downside protection during times when the traditional markets are experiencing significant draw-downs. For example, during the 2008 market meltdown, managed futures were actually up. Other examples include market neutral, long-short managers, etc.

Absolute Return Leg

The “Absolute Return Leg” role is also to reduce volatility and provide consistency of returns. For example, opportunities include direct lending, real estate, and others. We seek equity type returns with little to no volatility. Often, lower liquidity is often a part of this leg but as a component, and not the whole portfolio, it plays an important role in establishing a solid investment strategy.

White Oaks purpose is to bring solid strategies, used by large endowments and wealthy families, to individuals, families, and organizations with $1,000,000 to $100,000,000 in investible assets. The three-legged stool approach can work to offset inflation, reduce volatility, and position a portfolio for the inevitable bumps along the way. In another article, Alternative Investments: 7 Principles for Selection, more information can be found regarding sourcing and investigating the second and third legs.