Some find it odd the focus on investing strategies for preserving wealth. After all, most of us spend much of our lives trying to accumulate a comfortable sum to acquire a sense of financial independence. Of course, those engaging in a competitive environment end up realizing no matter how much they pile up there is always someone with more. As a result, a common phrase that typifies the never-ending problem with comparison with respect to wealth is “the rich get richer and poor get poorer”.

Rich Get Richer?

Yet, the actual numbers of the “rich get richer” are difficult to support with actual numbers. In an article entitled “High Turnover Among America’s Rich” explained that 70% of the Individuals and Families in the 1982 Forbes 400 were no longer on the list in 2014! Clearly investing strategies for preserving wealth are important in keeping financial independence.

Cash: Prime asset in investing strategies for preserving wealth.

Extremely liquid but low returning assets such as cash are the most under-appreciated investment assets in an investing strategy. Furthermore, the use of cash will seldom be the best performing asset in a portfolio. Of course, market disruptions do happen, however, and having 12-24 months living expenses in cash can provide the staying power to allow other assets to have their day in the sun again. Investing strategies for preserving wealth, as described in the previous post “The C, B, A’s of Investing” points out, a sound strategy begins with how much cash will be needed in difficult markets. Above all, the effective investing strategy for preserving wealth cash is primary, not an afterthought.

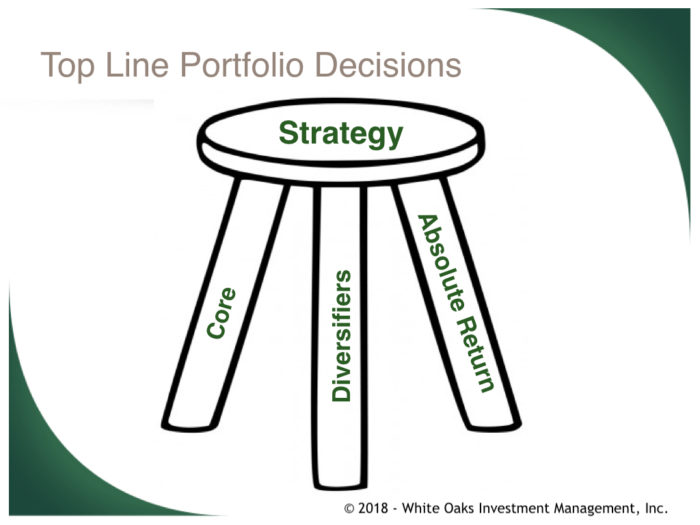

White Oaks Three-Legged Stool™

White Oaks Three-Legged Stool™

Diversification is also a prime consideration to preserve wealth. Traditionally, Stocks, Bonds and Cash, long a staple of portfolio construction, are components of diversification. Yet, in today’s world of investing, there are many other tools to reduce volatility that should be considered part of investing strategies for preserving wealth.

Core Leg

Above all, the 3 Legged Stool is the White Oaks tool for describing the process of portfolio construction. That most importantly, assumes the investor wants to reduce volatility while achieving equity type returns. Stocks, Bonds and Cash, long the staples of portfolios are in the Core leg. Betting against the long-term growth of the global economy is a low probability wager.

Equity investment markets are up 70% of the time. It is like having a coin that comes up heads 70% of the time and betting tails. Yes, you would be right 30% of the time but wrong 70%. Due to this, equities provide, over time, inflation-beating investment returns protecting purchasing power.

Diversifier Leg

The volatility of equities in the Core leg of the 3 legged stool is challenging. Therein the reason for the other two legs. The Diversifier leg is populated by investments that offer low to negative correlation to the Core leg. Correlation put simply, is how assets tend to act in relation to each other.

Assume asset ‘A’ goes up 10% and asset ‘B’ goes down 10%. This is an example of negative correlation of -1. If both moved up 10% the correlation would be +1. Imagine a portfolio where all assets were perfectly correlated at +1. Certainly, because the assets all move in coordination with each other, the net impact is that is there is little diversification value in the portfolio.

The diversifier leg seeks assets that have low to negative correlation with the core leg. Of course, this means there is usually a part of the portfolio that the investor is unhappy with. That’s diversification for you! Smoother, more consistent returns with always a part of the portfolio you wish weren’t there at the moment.

Absolute Returns:

Thar brings us to the third or Absolute Return leg. Consistent income with limited/lower volatility are key attributes of this leg. Real estate that delivers consistent cash flow would be one example. Master Limited Partnerships in energy space or a loan portfolio are just a couple more examples. Cash distributions nearing equity type returns is a focus of our firm in sourcing ideas for client investing.

Due Diligence/Sourcing

The process of identifying and researching is standard fare for the Core leg. As a result, the Diversifier and Absolute Return legs require a solid process to move forward. Therefore, in a previous post “Alternative Investments: Seven Principles for Selection” the process White Oaks uses to select and identify potential opportunities is laid out. Most noteworthy, these principles are explored in more depth in my book “The Other Path” as well.

In all cases, liquidity needs to be considered in allocating assets to the second and third leg of the stool as some offerings may not have immediate liquidity. As mentioned above, having an appropriate amount of cash should mitigate those concerns allowing for greater returns and higher wealth preservation.

Summary Investing Strategies for Preserving Wealth

Accumulating wealth requires hard work, discipline, and making sometimes difficult choices. For that reason, shifting the perspective from accumulation to preservation comes intuitively for many. As a result, sometimes that intuition pulls an investor to low-return investments that will prevent them from protecting their purchasing power. Certainly, this can be as disastrous to a financial independence strategy as taking on a very high level of risk. With increasing lifespans not offsetting inflation can erode the buying power of your assets. Using the White Oaks Three-Legged Stool™ one can put into place investing strategies for preserving wealth. This approach serves to protect their purchasing power. Similarly, using a balanced approach to asset allocation enhances the probability of success that one works so hard for.