In part one of this series of posts, Pursuing the Perfect Portfolio Design, we explored the paradox of the war of passive investing versus active investing strategies. Main advantages included the lower cost of accessing passive strategies, especially the well researched and and more developed asset classes of the United States and Developed International. The low transactional turnover leads to lower taxes as well. There isn’t much not to like when investing in well developed equity markets. To be sure, diversification matters a great deal.

Unfortunately, too many active managers use an “index hugging” approach to their portfolio management style. To be close to the index (benchmark) the manager buys mostly the same securities that are in an index fund and charges more in the way of a management fee, trading costs, and tax consequences. Mostly the same and costs more? Not a shrewd buying principle for anything, let alone investing!

If that is the case why wouldn’t all investments go into index funds? Simply because not all investment opportunities are as widely followed as the US Stock and Bond markets or Developed International. Even within these markets, opportunities exist to be exploited, and the desire to avoid volatility is important to people who actually use their money. This last statement may seem strange to many. Who doesn’t need to use their money at least occasionally? Well the über rich would be a good example. Their lifestyle needs can be satisfied with a very small portion of their capital; volatility (fluctuation) of the portfolio doesn’t matter very much. This was explored in detail in a previous writing, Alternative Investments: How Less Is More, and my newest book, The Other Path: Illuminating the Path Toward Reduced Volatility While Achieving Equity Type Returns. Volatility matters for the vast majority of people. The the chart below shows the impact of volatility is significant.

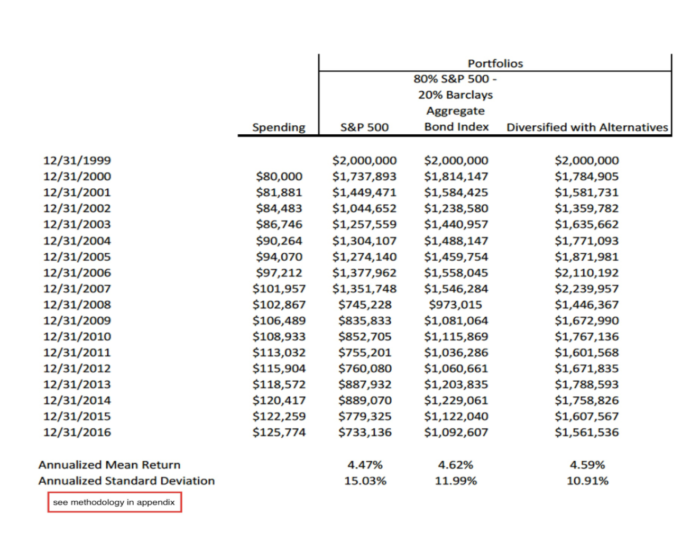

In the chart above, the impact of volatility is dramatically demonstrated by the three portfolio designs using indexes of various asset classes. The column entitled S&P 500 is the index, gross of any fees, as is the column entitled 80% S&P 500 – 20% Barclays Aggregate Bond (bond index).

Note in the bottom two lines entitled “annualized mean return” and “annualized standard deviation (measure of the volatility/fluctuation of the strategy),” you might be surprised to note the large difference in the ending balances and that the rates of return are nearly identical. Clearly, it was not the return that made the difference

This illustration assumes a $2,000,000 starting portfolio, beginning January 1, 2000, and inflation adjusted withdrawals starting at 4% of the starting portfolio value. Over $1.7 million in withdrawals happen over the 16 years. Since the returns for each portfolio design were not appreciably different, one might expect the ending balances to be very close to each other. Columns two and three show vastly different ending balances and the withdrawals were exactly the same. The difference? The portfolios in the right two columns had less wiggeleness or volatility. When withdrawals were made, less capital was withdrawn, preserving more money for later. This time period was used due to the fact two very significant down markets were experiences, and the markets recovered.

For real people with real portfolios, volatility is a major issues to be considered to achieve financial independence. To ignore it, one must either reduce retirement expectations or accumulate significantly more assets to meet the stated goals. Alternative investments can be viewed as additional tools in the investment toolbox. Like with any tool or craft, care must be used. To use alternative investments in a portfolio, one should not simply pull an investment product “off the shelf like an investor might with an index fund.

In the next installment of this series will discuss additional considerations for exploring and implementing new tools to the portfolio design.